FairLabs Team

2024. 8. 5.

Weekly ESG Controversies (July 29 ~ August 4)

Key Takeaways

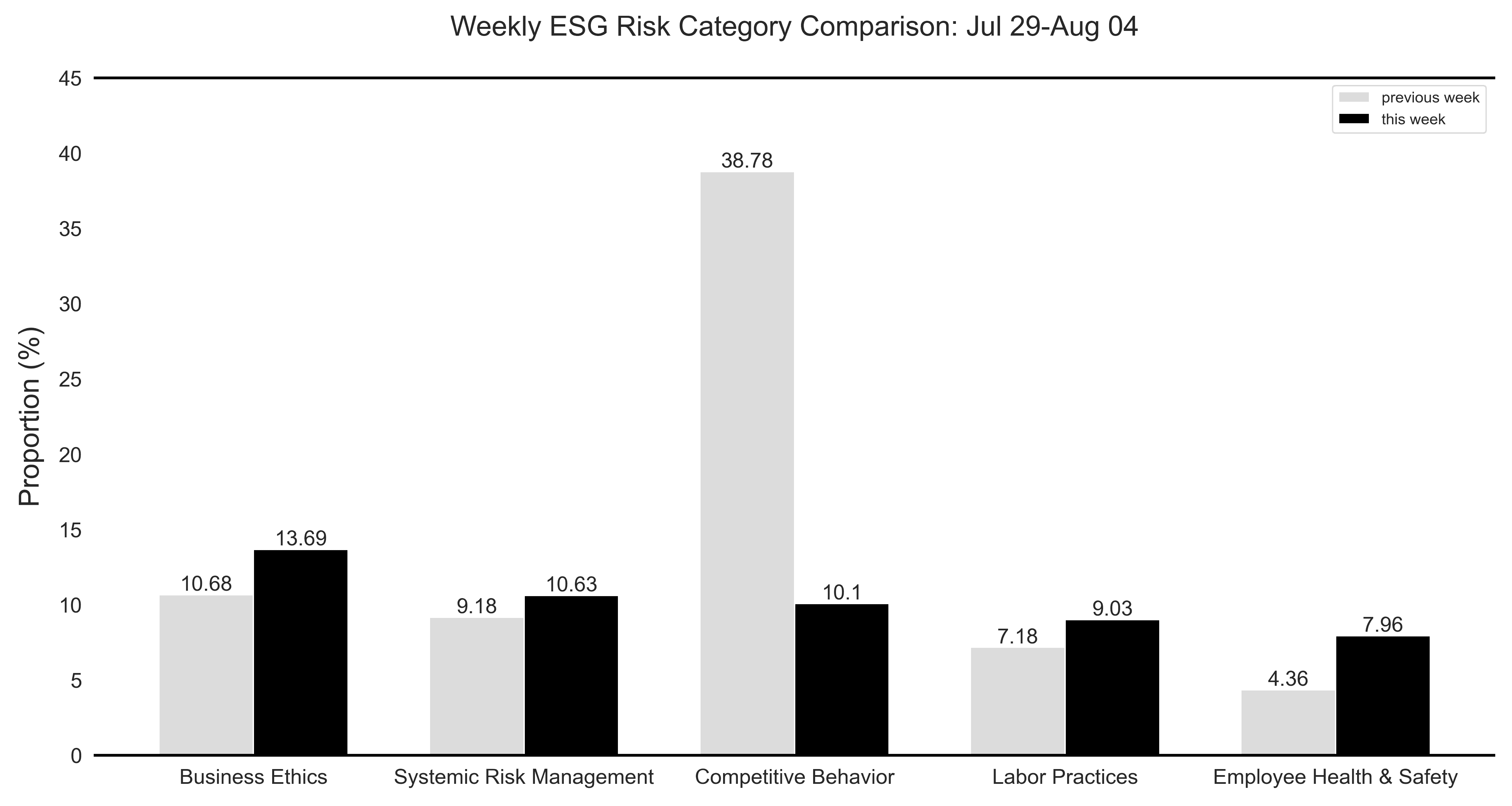

Increase in Business Ethics Risks:

This week, business ethics risks have notably surged, accounting for 13.69% of the total risk assessment, the highest share recorded.

Notably, NH INVESTMENT & SECURITIES is highlighted with a 21.74% share due to sanctions imposed for golf hospitality aimed at securing retirement pension contracts.

Growing Concerns Over Systemic Risks:

With a forecasted peak in power demand for this summer, recent blackouts in Gwangju and Busan have heightened concerns about the power supply system.

In the hyper-connected era, there is increased apprehension over large-scale system errors and security incidents after Microsoft's cloud update failures.

The Tmon and WEMAKEPRICE crisis has brought financial stability to the forefront of discussions within the domestic e-commerce sector, with predictions that PG (payment gateway) companies might face challenges in recovering claims in the event of TMAP’s bankruptcy.

Samsung Electronics' Labor Union Negotiation Breakdown:

Prolonged labor strikes and escalating conflicts have led to a breakdown in negotiations with the labor union, accompanied by allegations of maintaining a blacklist of strike participants, intensifying the conflict.

Recurring Factory Fire Incidents:

Following a Department of Labor inspection last year, which cited deficiencies and issued corrective orders related to explosion protection at S-Oil’s Ulsan plant, a recent explosion on the 28th has reignited controversy over the recurring fire incidents at the plant each year.

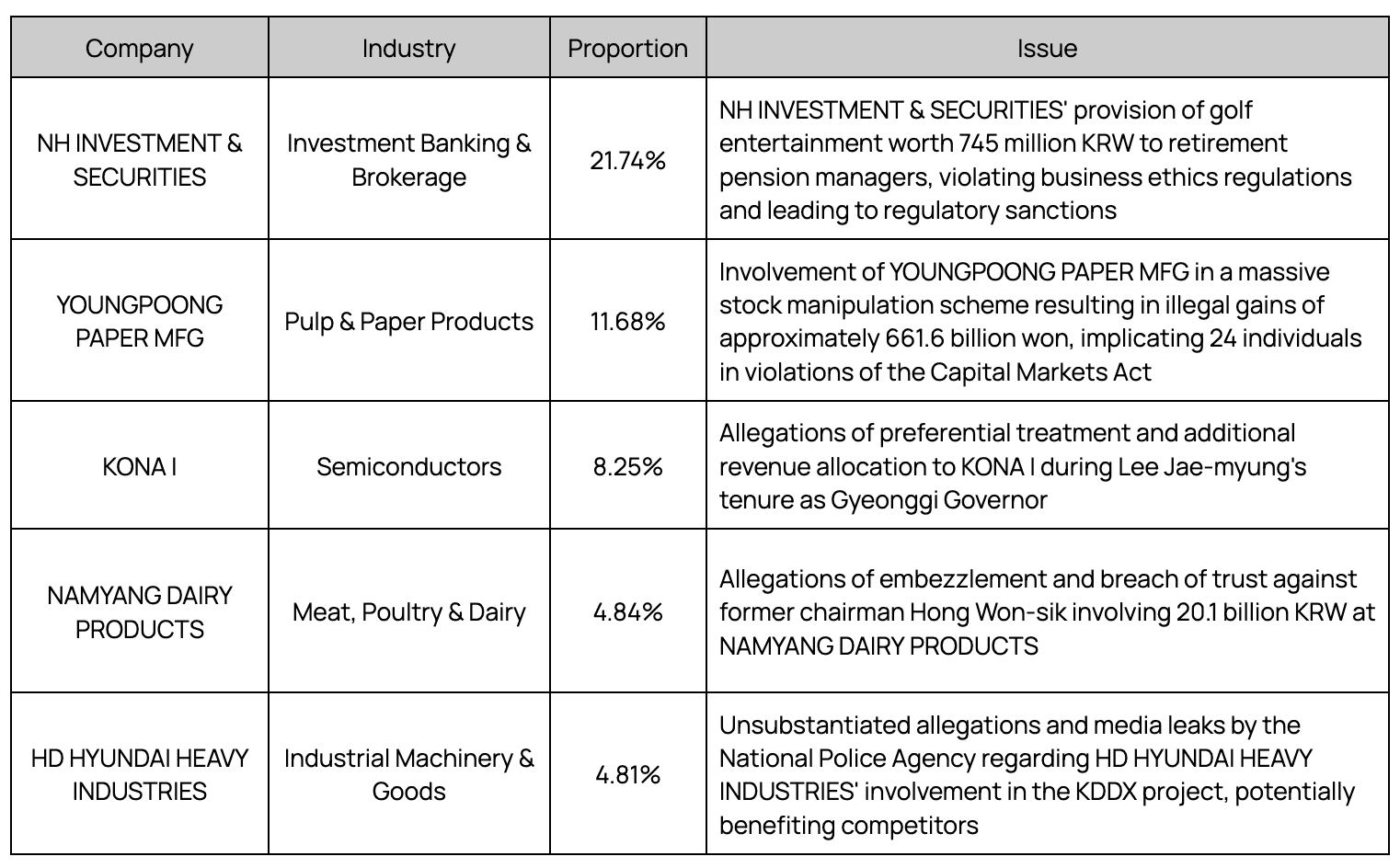

Business Ethics (13.69%)

NH INVESTMENT & SECURITIES faced the biggest controversy, accounting for 21.74%, due to a golf hospitality scandal aimed at securing retirement pension contracts.

A key accomplice in the stock manipulation case involving YOUNGPOONG PAPER MFG, who provided 17 billion KRW (approximately 170 million USD) in funds, has been indicted and detained.

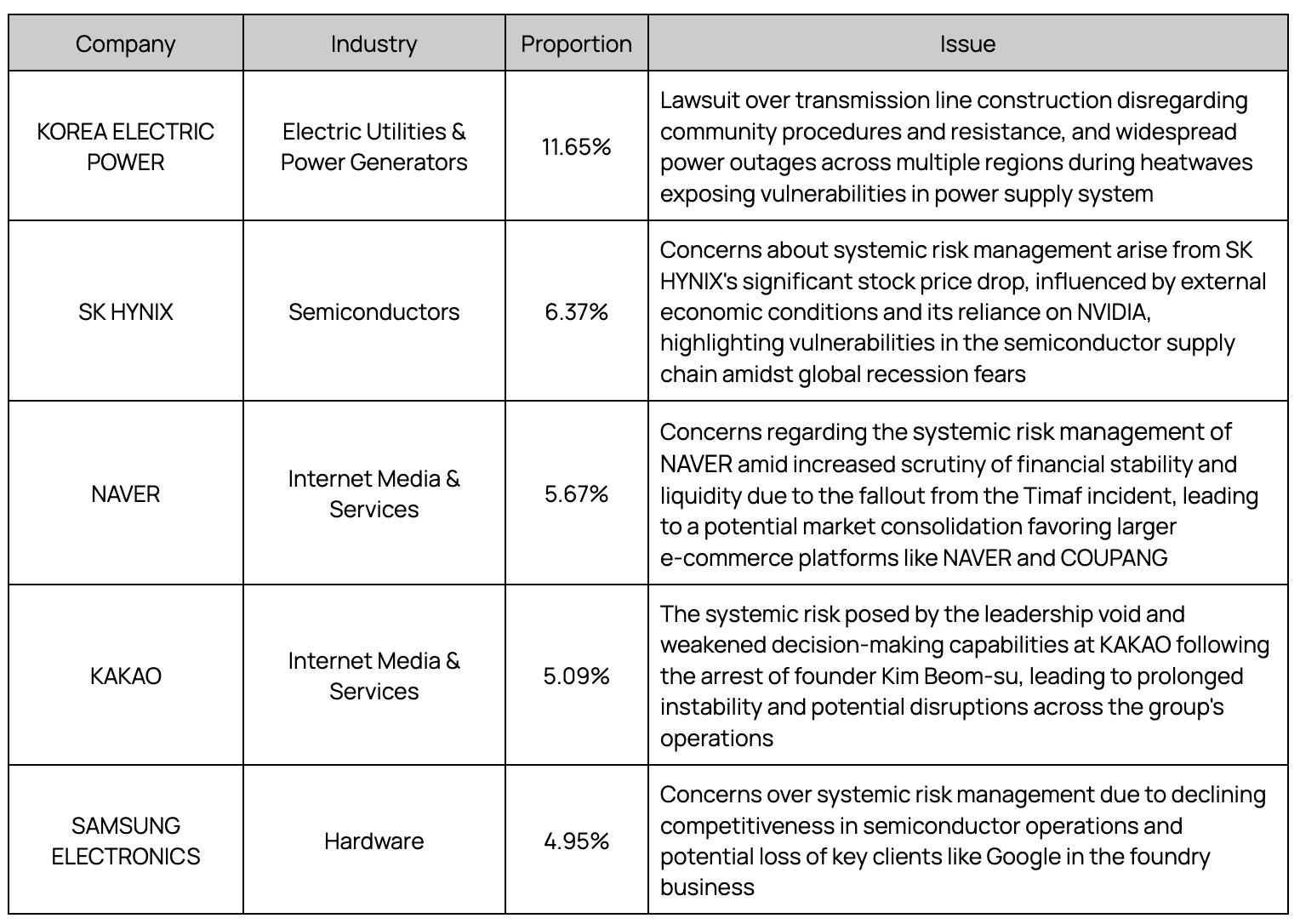

Systemic Risk Management (10.63%)

Korea Electric Power Corporation (KEPCO) is facing legal disputes related to transmission line construction. Additionally, consecutive large-scale blackouts in Busan and Gwangju have raised concerns over the power supply system.

Companies are increasingly exposed to systemic risks due to global economic volatility, leadership vacuums, and incidents such as the TMAF crisis.

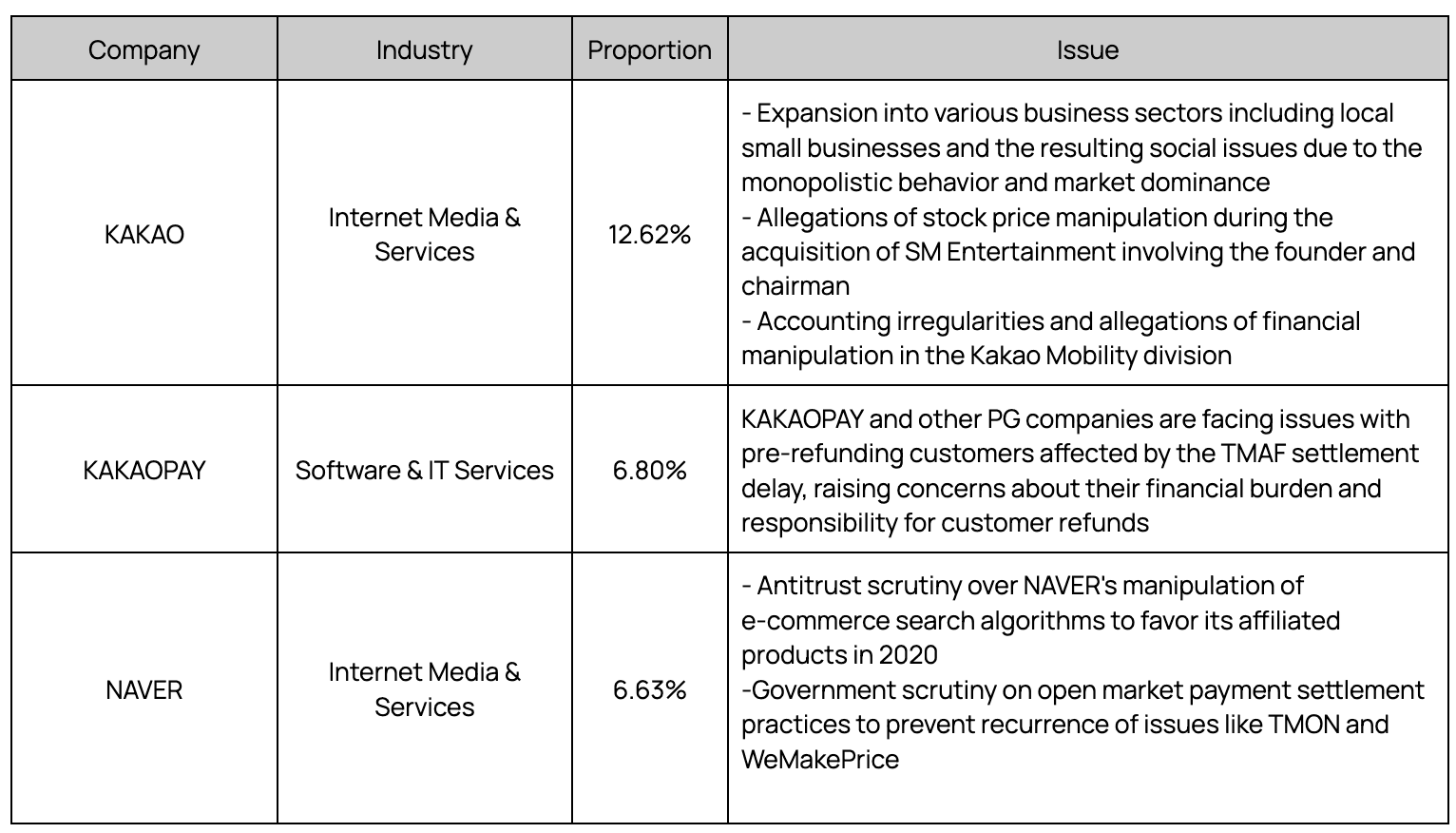

Competitive Behavior (10.1%)

KAKAO has been facing ongoing controversies due to allegations of stock price manipulation during the acquisition battle for SM Entertainment, suspicions of accounting fraud at Kakao Mobility, and criticism of its sprawling business expansion strategy.

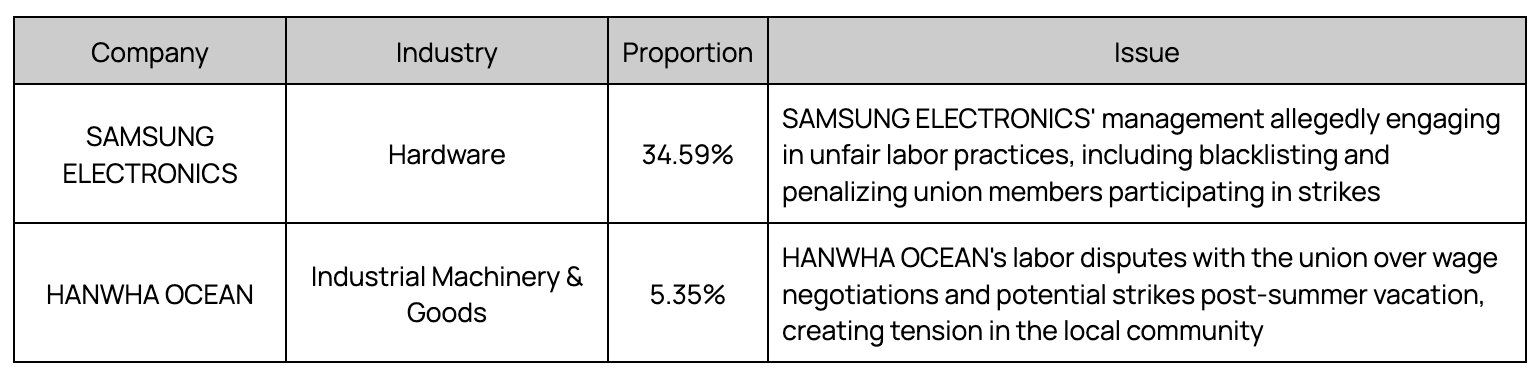

Labor Practices (9.03%)

SAMSUNG ELECTRONICS is facing allegations of maintaining a blacklist of strike participants amid a breakdown in negotiations with the labor union.

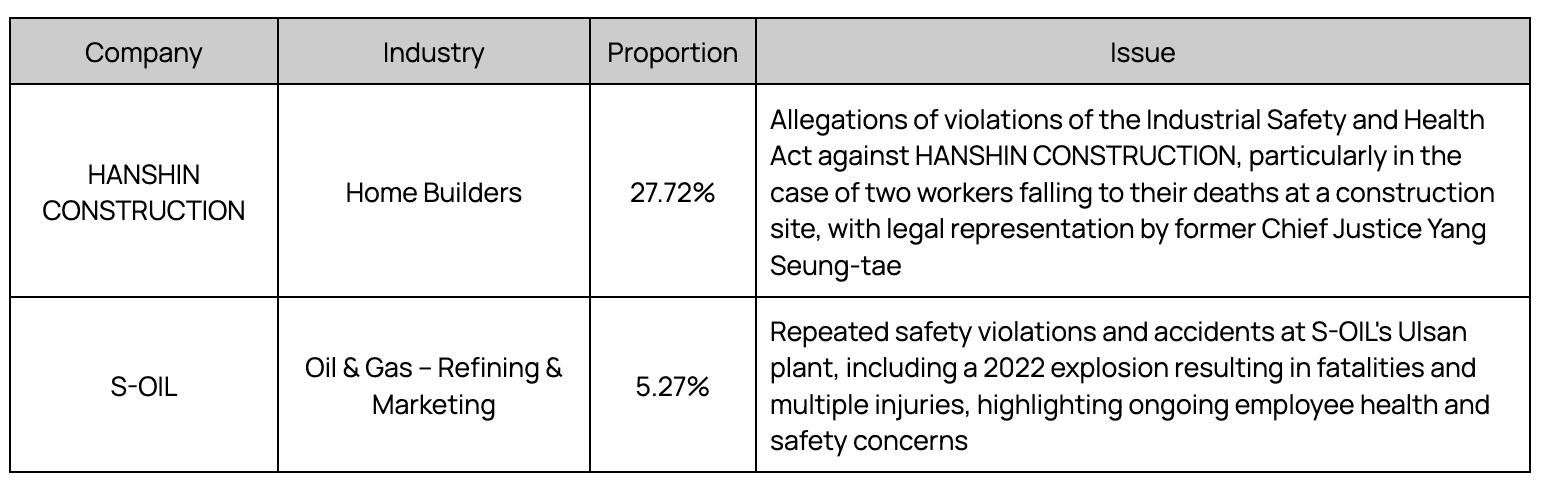

Employee Health & Safety (7.95%)

The former Chief Justice’s involvement as a lawyer in a case being reviewed by the Supreme Court has drawn unusual attention, highlighting the ongoing issue of Hanshin Engineering's alleged violation of industrial safety and health laws in 2019.

S-Oil has come under criticism following a recent explosion at its Ulsan plant on the 28th, which occurred in the wake of major fire and explosion incidents in 2022 and 2023

This week’s ESG analysis report highlights an unprecedented occurrence, with Business Ethics and Systemic Risk Management ranking as the top two risk categories. It highlights how a single type of risk can manifest in various forms across different industries.

In the Business Ethics category, previously dominated by allegations of stock price manipulation and embezzlement, new concerns have emerged including golf hospitality for contract acquisition, improper solicitations, and political favoritism. Meanwhile, in the Systemic Risk Management category, which was primarily focused on judicial risks and communication service disruptions in recent, emerging risks now include power supply issues at KEPCO due to frequent blackouts and financial stability concerns within the e-commerce sector and payment gateway providers following the TMON-WEMAKEPRICE crisis.

Notably, while liquidity crises in construction project financing have been widely warned about, similar warnings for the e-commerce sector have been less common. This highlights the importance for stakeholders to closely examine past and current risks, and assess how effectively these risks are managed in other companies and industries.

Disclaimer: This content was made with the help of AI. It may contain errors or inaccuracies, and should not be relied upon as a substitute for professional advice. The information contained in this article is not investment advice. FairLabs does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

All rights reserved. © FairLabs 2024

Latest Posts