FairLabs Team

2024. 9. 23.

Weekly ESG Controversies (September 16~22)

Key Takeaways

Allegations of Management Misconduct at KOREA ZINC

KOREA ZINC is currently under investigation for management misconduct, which has raised significant concerns regarding corporate governance and ethical practices within the company.

The controversy has led to a notable increase in scrutiny from investors and regulators alike, highlighting the need for improved oversight.

Legal Disputes and Governance Issues at YOUNGPOONG

YOUNGPOONG is embroiled in legal disputes, including a lawsuit against its own subsidiary and allegations of governance failures, which have drawn attention to its internal control mechanisms.

This situation is compounded by the company's ongoing struggles with management practices, as evidenced by the opposition from outside directors of KOREA ZINC regarding management decisions.

Stock Manipulation Allegations at DEUTSCH MOTORS

DEUTSCH MOTORS is facing serious allegations related to stock manipulation, which has raised questions about the integrity of its financial reporting and market practices.

Labor Strikes and Safety Concerns at SAMSUNG ELECTRONICS

SAMSUNG ELECTRONICS is experiencing labor strikes at its Chennai plant, highlighting ongoing labor practices issues and employee dissatisfaction regarding working conditions.

The situation reflects a growing trend of labor unrest in the tech industry, emphasizing the need for companies to address employee health and safety proactively.

Telecommunication Service Disruptions at KT

KT has faced backlash following a nationwide internet service disruption, raising concerns about its systemic risk management and operational resilience.

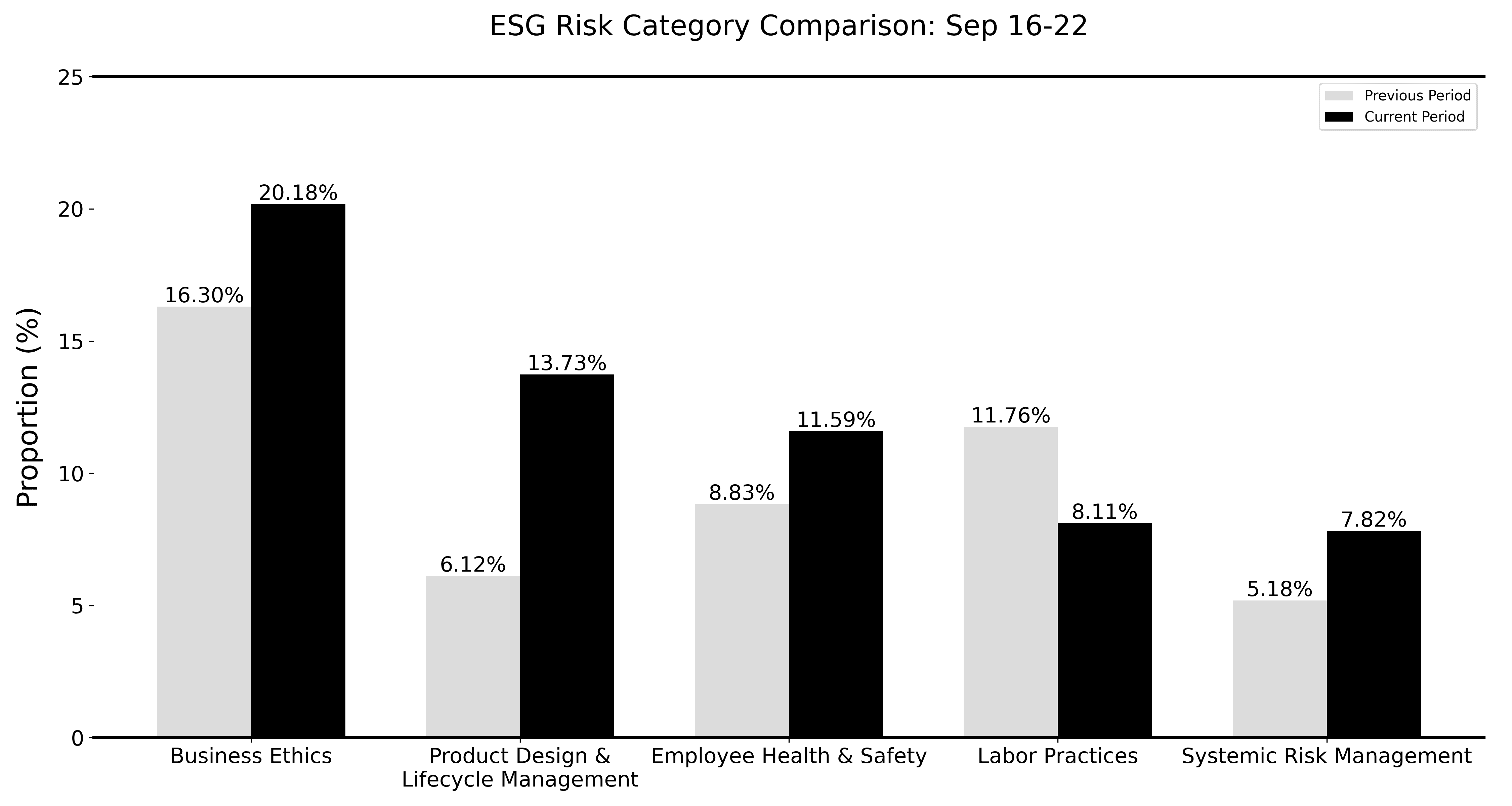

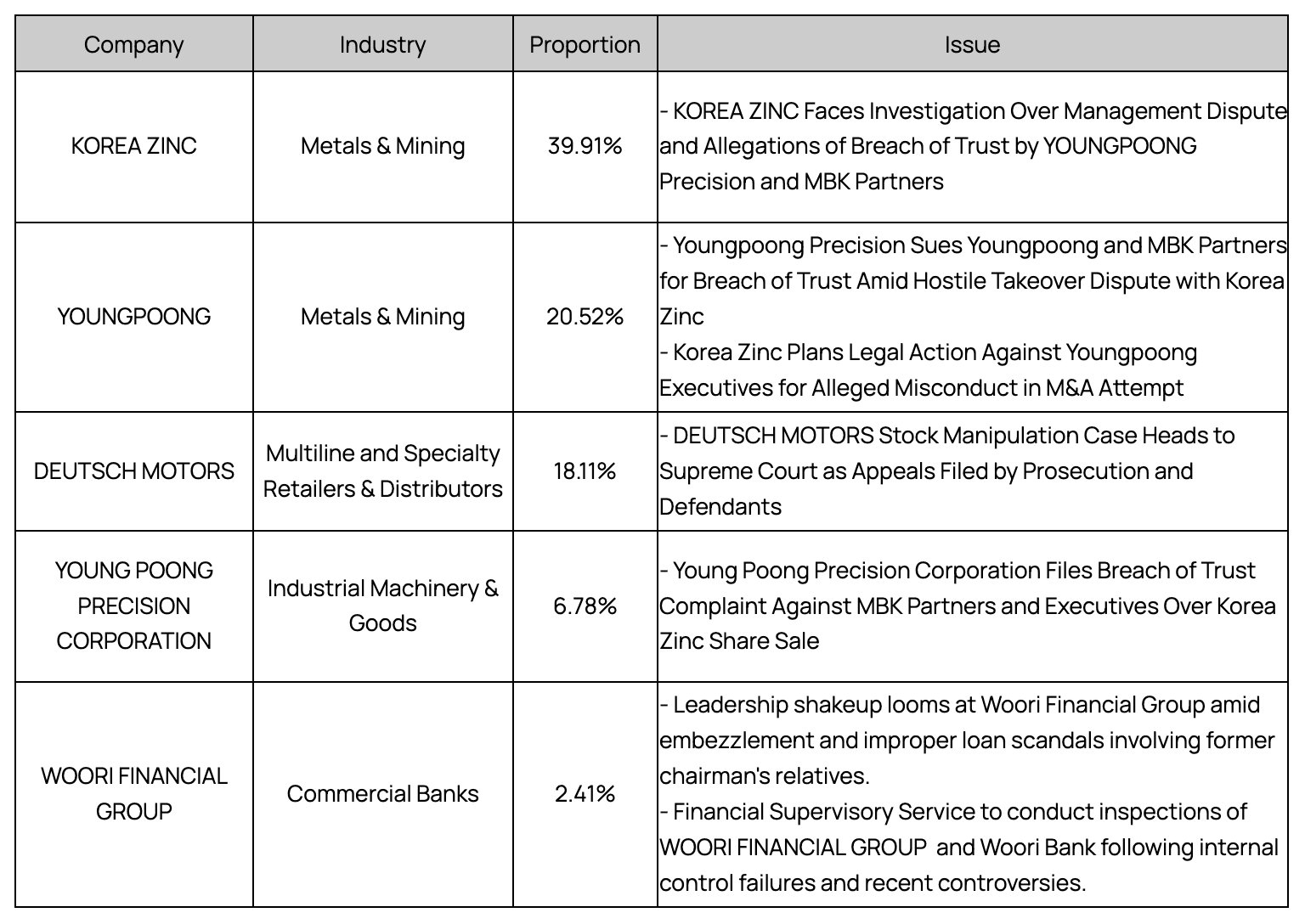

Business Ethics (20.18%)

KOREA ZINC is under investigation for management disputes, while YOUNGPOONG is engaged in legal battles, including a hostile takeover by MBK Partners. DEUTSCH MOTORS faces stock manipulation charges.

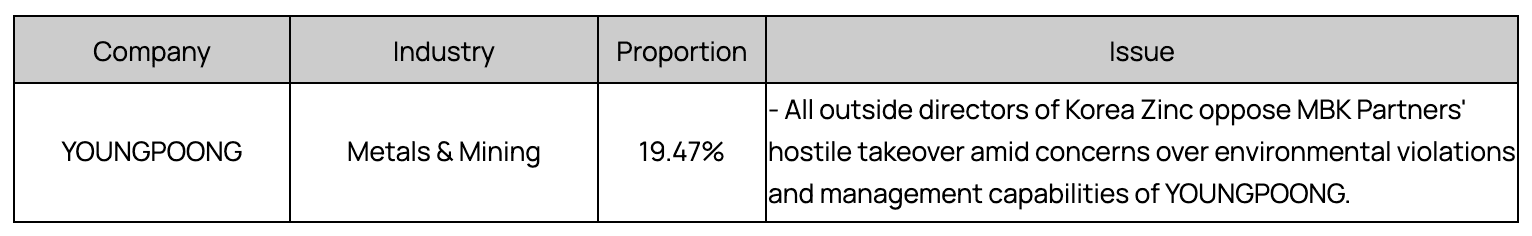

Product Design & Lifecycle Management (13.73%)

KOREA ZINC’s outside directors oppose MBK Partners' hostile takeover of YOUNGPOONG, citing environmental and governance concerns.

Employee Health & Safety (11.59%)

HANWHA OCEAN is investing nearly 2 trillion won in safety improvements following worker fatalities.

Labor Practices (8.11%)

SAMSUNG ELECTRONICS faces labor strikes at its Chennai plant, demanding wage increases and union recognition, while KOREA ZINC's labor union protests MBK Partners' takeover bid, citing job security concerns.

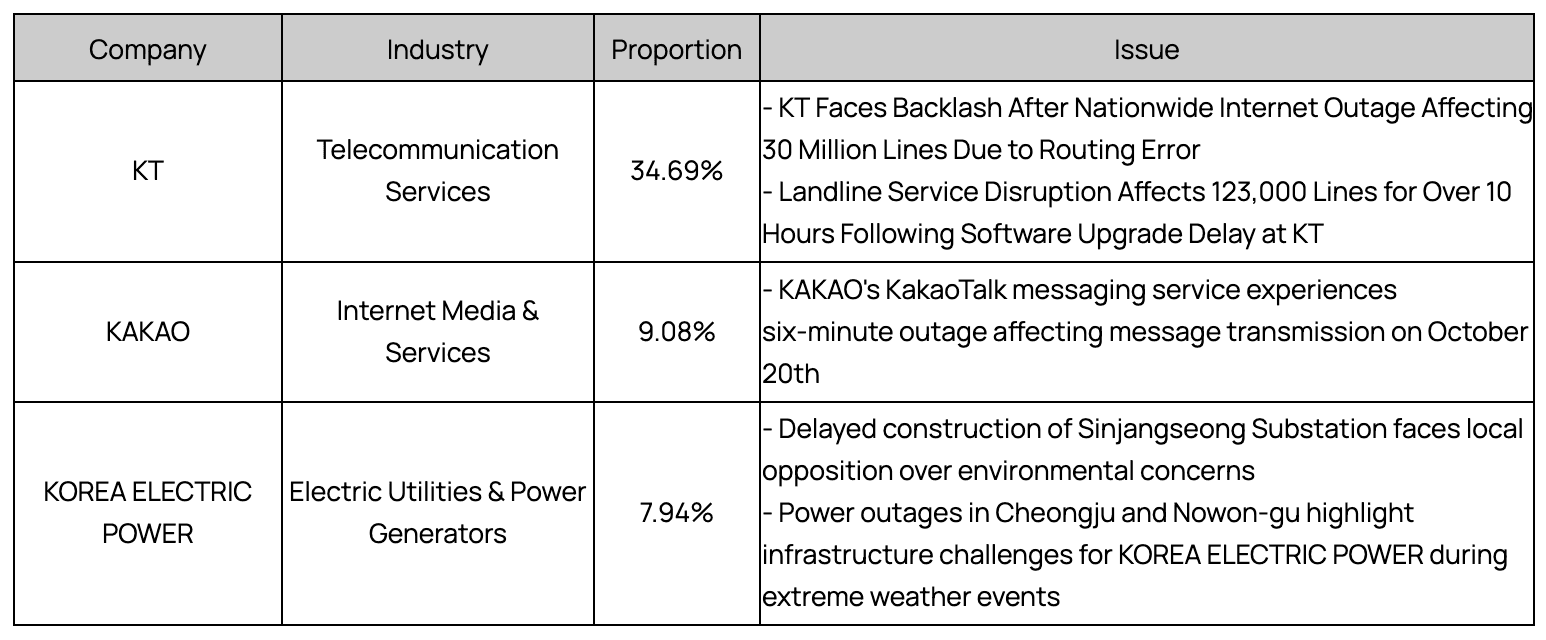

Systemic Risk Management (7.82%)

KT's nationwide internet outage exposed weaknesses in risk management, affecting millions of users.

This week’s review underscores significant governance, labor, and operational risks across multiple sectors, reinforcing the need for stronger oversight and risk management practices. KOREA ZINC's investigation and YOUNGPOONG's legal disputes highlight the importance of ethical corporate governance, as both companies face increased regulatory scrutiny. The hostile takeover bid by MBK Partners has brought environmental violations and governance concerns to the forefront, impacting both YOUNGPOONG and KOREA ZINC.

Meanwhile, labor unrest at SAMSUNG ELECTRONICS and KOREA ZINC signals a growing trend in worker dissatisfaction, urging companies to prioritize employee welfare and secure long-term operational stability. In parallel, KT's nationwide outage demonstrates the critical importance of systemic risk management in safeguarding customer confidence and maintaining business continuity.

As these trends evolve, companies must focus on enhancing corporate governance, improving labor practices, and reinforcing risk management frameworks to mitigate reputational and financial risks. The coming weeks will require close monitoring of these developments, as they could lead to further regulatory interventions and affect investor confidence in the broader ESG landscape.

Disclaimer: This content was made with the help of AI. It may contain errors or inaccuracies, and should not be relied upon as a substitute for professional advice. The information contained in this article is not investment advice. FairLabs does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

All rights reserved. © FairLabs 2024

Latest Posts