FairLabs Team

2024. 9. 30.

Weekly ESG Controversies (September 23~29)

Key Takeaways

Legal Battles and Corporate Governance at KOREA ZINC

KOREA ZINC is embroiled in a legal battle as Youngpoong accuses its chairman of misconduct, raising serious concerns about corporate governance and ethical practices.

Heightened Concerns Over Employee Health and Safety

Samsung Electronics is under scrutiny following a series of health and safety violations, which have led to potential fines and calls for tighter regulatory oversight in its manufacturing processes.

Similarly, S CONNECT faces backlash after former executives were charged with negligence over a fatal factory incident.

Meanwhile, a recent fatality at Hanwha Ocean’s Geoje facility has reignited debate on workplace safety, pushing for comprehensive safety protocols in high-risk industrial settings.

Environmental Management Failures at Youngpoong

Youngpoong is facing severe criticism for mishandling hazardous waste at its Seokpo Smelter, raising urgent questions about the company’s environmental management practices and compliance with sustainability standards.

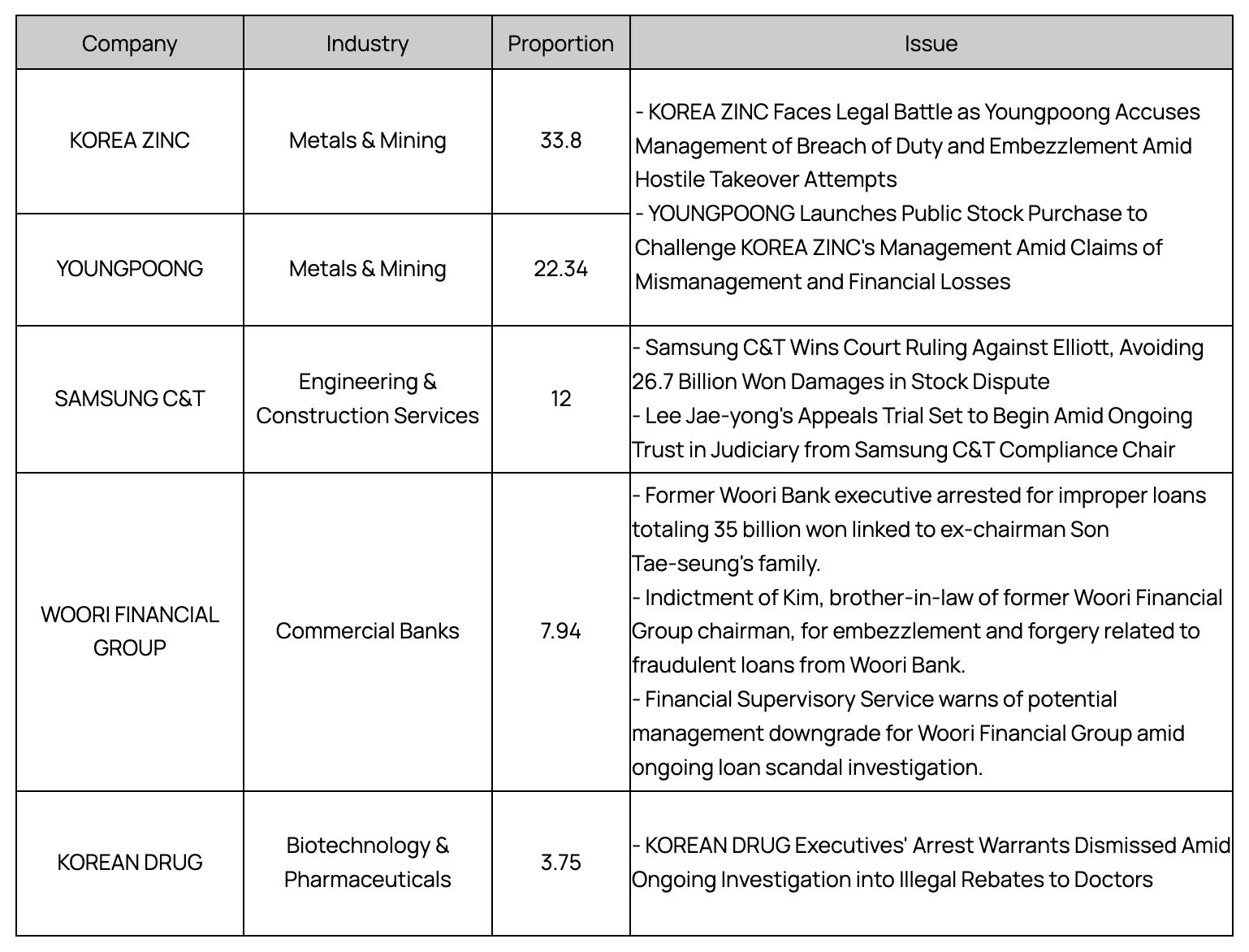

Business Ethics (20.89%)

Legal disputes at Korea Zinc and Youngpoong reveal severe governance risks, highlighting internal mismanagement and shareholder conflicts. Woori Financial’s loan scandal further underscores vulnerabilities in oversight. Investors should anticipate potential regulatory scrutiny and governance shifts.

Competitive Behavior (13.71%)

Korea Zinc faces nepotism allegations, while Kakao’s monopolistic practices spark regulatory backlash. Such controversies heighten the risk of increased antitrust regulations, potentially impacting profitability and market positioning.

Employee Health & Safety (8.44%)

Samsung and Hanwha Ocean are under scrutiny for serious safety violations, risking operational disruptions and reputational damage. Strong safety management is crucial to mitigate legal liabilities and preserve investor confidence.

Waste & Hazardous Materials Management (6.67%)

Youngpoong’s hazardous waste mismanagement exposes it to environmental liabilities and reputational damage. ESG investors should monitor compliance with sustainability standards and regulatory developments.

Product Design & Lifecycle Management (5.90%)

Product quality concerns at Youngpoong, stemming from leadership conflicts, may lead to supply chain disruptions and client dissatisfaction. Investors should evaluate stability and quality control measures in the company’s operations.

This week’s ESG controversies bring into focus critical governance, competitive behavior, and safety management challenges across multiple industries. The legal battles between Korea Zinc and Youngpoong highlight the urgent need for stronger corporate governance frameworks to prevent internal conflicts and safeguard shareholder interests. Similarly, Kakao’s monopoly practices and the backlash from stakeholders signal that the tech sector may face heightened regulatory scrutiny going forward.

Meanwhile, the safety violations at Samsung Electronics and Hanwha Ocean emphasize the high stakes involved in maintaining robust safety standards, as lapses can lead to severe financial penalties and reputational fallout. Youngpoong’s environmental mismanagement underscores the growing importance of sustainable operations in the mining industry, where any compliance failure can significantly damage a company’s standing.

Emerging trends indicate that companies operating in high-risk sectors must prioritize proactive risk management and strategic governance improvements to protect against legal repercussions and maintain stakeholder trust. Investors should closely monitor how these companies respond to these controversies, as their handling could influence long-term stability and market confidence.

Disclaimer: This content was made with the help of AI. It may contain errors or inaccuracies, and should not be relied upon as a substitute for professional advice. The information contained in this article is not investment advice. FairLabs does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

All rights reserved. © FairLabs 2024

Latest Posts